The foundation of Stack Financial Management’s investment philosophy is a belief that portfolio construction must be based on a thorough assessment of market risk. With careful attention to the historical forces that move the market, SFM utilizes a “safety-first” approach to investment management.

Our respect for risk in the pursuit of profits has led to the evolution of the investment methodology which we employ in constructing portfolios and selecting securities. Many other firms profess the ability to forecast market turning points. At Stack Financial Management we are focused on following the weight of the evidence and allowing an objective assessment of the data to dictate our risk management strategy.

Our primary objective is to maximize long-term returns in a manner that reduces volatility and emphasizes preservation of capital. Through measured asset allocation and security selection, our goal is to provide an opportunity for superior risk-adjusted returns over a full market cycle.

The Importance of Managing Risk

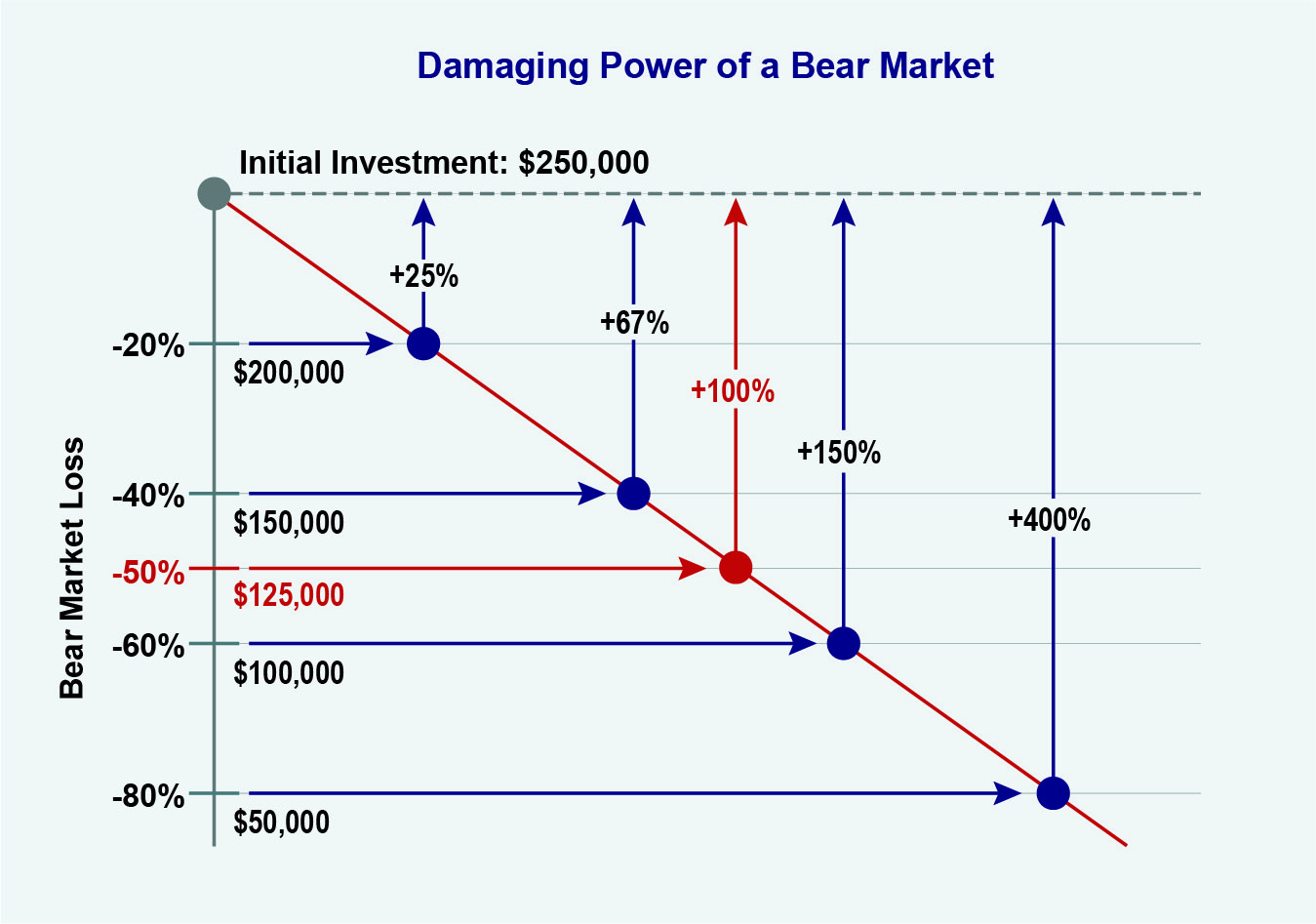

Most investors are familiar with the concept of Compounding Interest and how it increases returns over time. It is one of the simplest but most powerful forces in all of investing. However, most investors fail to realize the damaging power of “reverse” compounding. For example, a -20% loss requires a gain of +25% to get back to even. However, in a more severe bear market like 2000-02 or 2007-09, the S&P 500 can lose -50% or more – which requires a +100% gain to fully recover! As losses become more extreme, so does the effect of reverse compounding. This is why the foundation of our investment philosophy is risk management – minimizing losses is critical to the long-term success of your investment portfolio.

The above chart outlines the destructive nature of a bear market:

- A 40% loss is not 2 times worse than a 20% loss…it is 2.5 times worse!

- A 60% loss is not 3 times worse than a 20% loss…it is 6 times worse!

- An 80% loss is not 4 times worse than a 20% loss…it is 16 times worse!