The foundation of our investment philosophy is a belief that portfolio construction must be based on a thorough assessment of market risk. With careful attention to the historical forces that move the market, SFM employs a “safety-first” approach to money management.

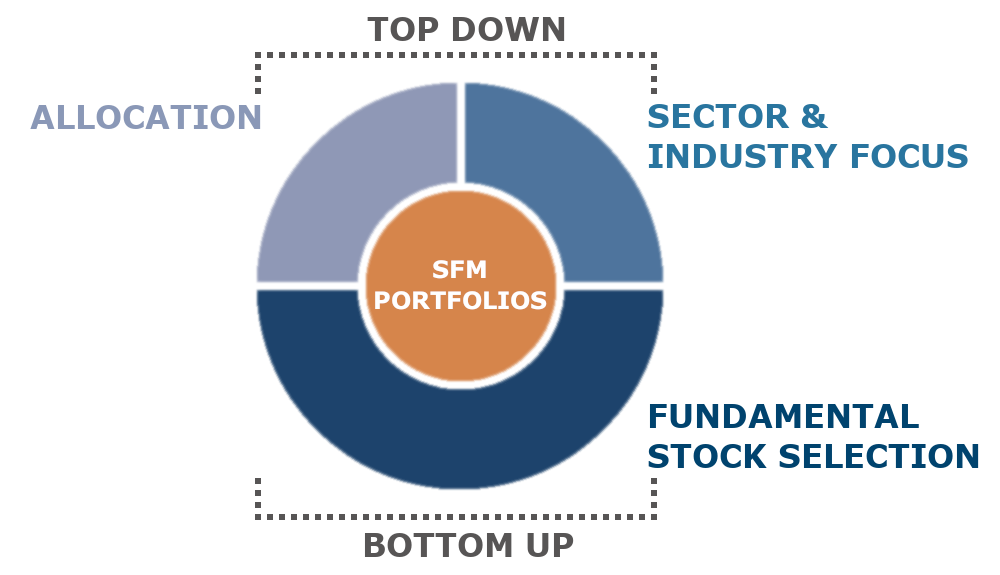

We utilize a 3-step process to manage risk and construct portfolios that marry our macroeconomic and technical views with bottom-up fundamental analysis.

Our unique brand of active risk management aspires to achieve returns that meet or exceed long-term averages while reducing risk and volatility – providing the all-important “Sleep at Night” factor for our clients.

The most effective tool in our arsenal is allocating assets to the equity market based on the level of risk.

The most effective tool in our arsenal is allocating assets to the equity market based on the level of risk.

Allocation decisions are made by evaluating the “weight of evidence” provided by technical and macroeconomic indicators to assess the business and market cycle.

When conditions warrant, an Inverse Index Fund may be used to offset a portion of the portfolio’s equity allocation.

This strategy is not market timing – it’s risk management. It requires objectivity and discipline to make allocation decisions based on the message these tools convey.

Sector weighting is a valuable tool in managing risk as sector leadership changes throughout a full market cycle. An active sector strategy should vary based on market conditions, the level of risk, and relative valuations.

Sector weighting is a valuable tool in managing risk as sector leadership changes throughout a full market cycle. An active sector strategy should vary based on market conditions, the level of risk, and relative valuations.

This analysis is taken a step further by incorporating industry-based data as well. While companies within a sector might perform vastly different over the course of a market cycle, industry-based peer groups tend to correlate more tightly.

Our proprietary ranking methodology evaluates sectors and industries based on five different metrics to create an internal SFM SCORE. This score helps guide our investment decisions during the portfolio construction process.

The third step in protecting one’s portfolio is buying good companies based on detailed, fundamental analysis. When selecting stocks, we focus on four key areas in addition to our proprietary SFM SCORE:

The third step in protecting one’s portfolio is buying good companies based on detailed, fundamental analysis. When selecting stocks, we focus on four key areas in addition to our proprietary SFM SCORE:

Superior Profitability & Growth

Look for steady revenue growth, profit margins that are better than peers, and strong return on equity metrics

Competitive Advantage

Focus on market leaders that enjoy high barriers to entry

Financial Strength & Discipline

Find companies with strong balance sheets, manageable debt levels, and consistent free cash flow generation

Attractive Valuation

Seek out firms that are pricing at a discount to their intrinsic value based on relative metrics